Most people compare monthly rent vs. monthly mortgage payment and stop there. But that comparison misses several important costs—and benefits—that can completely change the answer.

Let’s break down the real costs of renting vs. buying so you can make a confident, informed decision.

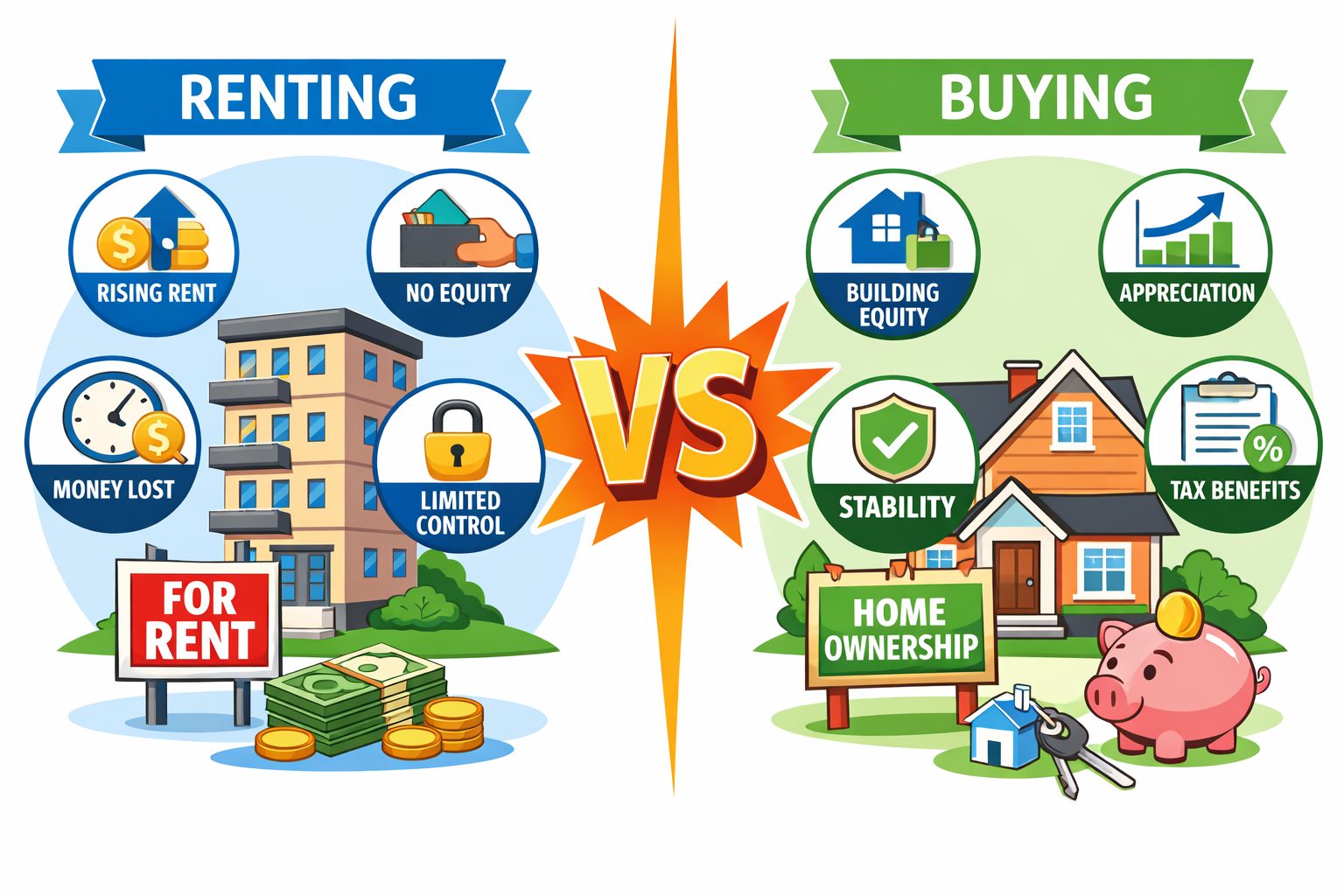

The True Cost of Renting

Renting often feels simpler—and in some cases, it is. But here’s what many renters don’t factor in:

1. Rent Increases

Rent typically goes up over time, sometimes significantly. While a mortgage payment can stay stable, rent almost never does.

2. Zero Equity

Every rent payment is gone once it’s paid. You’re covering housing costs, but you’re not building ownership or long-term value.

3. Limited Control

Want to paint, upgrade appliances, or make the space truly yours? Most rentals limit what you can do.

4. Missed Long-Term Opportunity

Many renters plan to buy “someday,” but rising prices and rates can make waiting more expensive than expected.

The True Cost of Buying (Beyond the Mortgage)

Buying a home does come with additional responsibilities, and it’s important to understand them upfront.

1. Upfront Costs

- Down payment (which doesn’t always have to be 20%)

- Closing costs

- Inspections and appraisals

These are real costs—but many buyers are surprised to learn how many programs exist to help reduce them.

2. Maintenance & Repairs

Homeownership means budgeting for things like:

- HVAC servicing

- Roof or appliance repairs

- General upkeep

A good rule of thumb is to set aside 1–2% of the home’s value per year for maintenance.

3. Property Taxes & Insurance

These are often included in your monthly payment, but they’re still costs to be aware of when planning.

What Buyers Often Forget to Count (The Upside)

This is where the comparison really changes.

1. Equity Growth

Every mortgage payment builds equity—money that stays tied to you, not a landlord. Over time, this can become one of your largest assets.

2. Appreciation

While markets fluctuate, real estate historically trends upward long term. That growth benefits homeowners, not renters.

3. Payment Stability

With a fixed-rate mortgage, your principal and interest payment stays the same—even while rent continues to rise.

4. Tax Advantages

Depending on your situation, homeowners may benefit from deductions related to mortgage interest and property taxes. (Always check with a tax professional.)

So… Which Is Better?

The right answer depends on:

- How long you plan to stay in the home

- Your financial comfort level

- Your long-term goals

If you’re planning to move in a year or two, renting may make sense.

If you’re looking for stability, long-term growth, and control, buying often becomes the stronger option—even if the monthly payment is similar.

A Smarter Way to Decide

Instead of asking, “Is buying cheaper than renting?”

Ask this instead:

“Which option moves me closer to my long-term goals?”

That’s the conversation I like to have with clients—no pressure, no assumptions, just clear information so you can make the right choice for you.

Final Thought

You don’t need to be “perfectly ready” to explore your options. A simple conversation can help you understand:

- What buying would actually cost

- What programs are available

- Whether renting or buying makes more sense right now

If you’re curious, I’m always happy to walk through the numbers and answer questions—before any commitments are made.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link