Online home value estimators have become go-to tools for both buyers and sellers. They’re fast, free, and easy to access — but they also come with important limitations that many homeowners don’t realize. Understanding what these tools do well — and where they fall short — can help you make smarter decisions.

What Are Online Home Value Estimates?

Websites like Zillow and Redfin use automated valuation models (AVMs) — algorithms that crunch data from public records, recent sales, tax assessments, and other available information — to predict what a home might be worth. These models are useful as starting points, but they’re just estimates — not professional appraisals or official offers.

How Accurate Are These Estimates?

1. Heartening Accuracy for On-Market Homes

When a property is actively listed for sale, online estimators have access to up-to-date MLS information, including professional photos, detailed descriptions, and pricing trends. In that scenario, the estimates tend to be much closer to actual sale prices.

For example, data compiled across national home sales shows that for on-market listings:

-

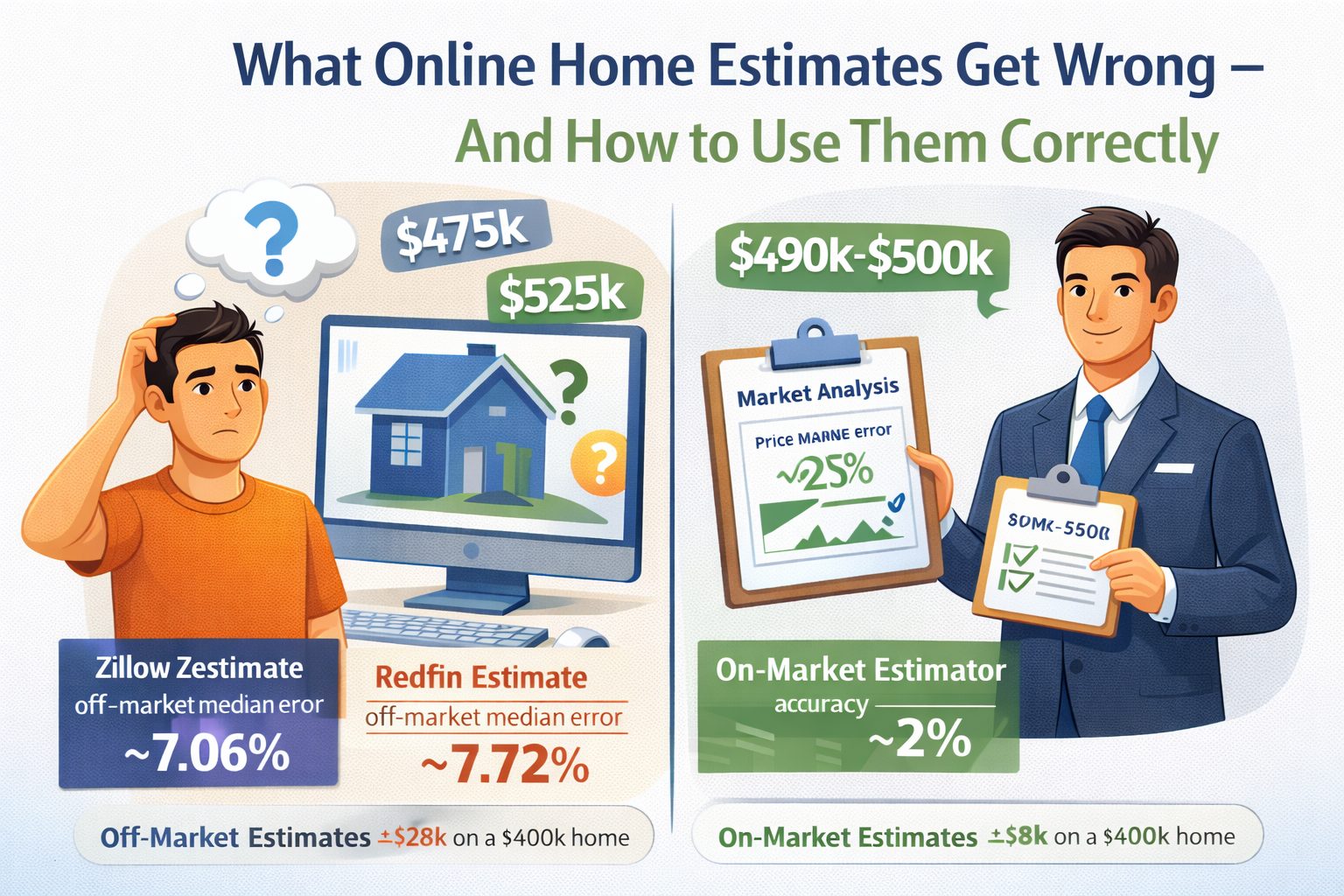

Zillow’s Zestimate has a median error rate of about 1.94%. That means half of all Zestimate values are within roughly 1.94% of what the home ultimately sells for.

-

Redfin’s estimate performs similarly, with a median error rate near 1.98%.

These numbers sound encouraging — when a home is listed, algorithms have lots of current, accurate data to work with. But it’s important to note: those figures apply only once a home is already on the market.

2. Big Gaps When a Home Isn’t Listed

When a home is off the market — such as when a homeowner just wants a rough idea of its value — the accuracy declines sharply.

For off-market homes:

-

Zillow’s median error rate increases to around 7.06%.

-

Redfin’s estimate rises to about 7.72%.

What does that mean in real dollars?

-

On a $400,000 home, a 7% median error could mean the estimate is off by ±$28,000 or more.

-

On a $600,000 home, that margin can exceed $40,000.

And these are median statistics — meaning half of the time the estimate could be even farther from the actual value. That’s why many homeowners are surprised when their online estimate differs significantly from what their home actually sells for.

Why These Estimates Miss the Mark

Here are some of the biggest reasons:

1. They Can’t See Condition or Upgrades

Algorithms assume homes are in “average” condition based on public records. But a remodeled kitchen, finished basement, or new roof often won’t show up in the data unless a human uploads that information. That means AVMs can seriously under- or over-value a home.

2. Outdated or Incomplete Data

Public records aren’t always current. Renovations that weren’t permitted won’t appear in tax data, and some databases lag behind real market conditions. If the algorithm doesn’t have accurate details, its estimate won’t be accurate either.

3. Rapid Market Changes Lag Behind Algorithms

These models are backward-looking, meaning they rely on past sales to predict value. In fast-changing markets, that backward look can make estimates feel out of date by weeks or months.

4. Neighborhood Nuances Are Hard to Quantify

Two homes that are identical on paper can sell for very different prices due to things like street noise, view, lot shape, or school district. Algorithms don’t always capture those subtleties well.

So What Should You Do Instead?

Online estimates certainly have value — especially for early research — but they shouldn’t dictate serious financial decisions.

✔ Use Them as a Starting Point

They’re great for getting a ballpark range of what similar homes in your area are worth.

✔ Check Multiple Sources

Compare values from Zillow, Redfin, Realtor.com, county tax assessments, and other tools. If several estimates line up, that range might be more reliable than any single estimate on its own.

✔ Talk to a Local Expert

A professional real estate agent can prepare a Comparative Market Analysis (CMA) tailored to your neighborhood — considering upgrades, condition, and local demand — something no algorithm can do with the same precision.

Bottom Line

Online value estimators like Zillow’s Zestimate and Redfin’s Estimate are useful tools — but they’re tools, not truths. Accuracy varies widely depending on whether your home is listed, how much data is available, and local market conditions. For most homeowners, these tools should be a first step — not the final word — in understanding their home’s worth.

When you combine online estimates with professional insight and up-to-date market data, you’ll be in the best position to make confident, informed decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link